Data center projects are becoming more capital-intensive, with demand for these facilities rapidly increasing. There are various ways for investors to fund data centers, and private placement is one of the quickest methods to raise funds from pre-selected, qualified investors. This method is relatively unregulated, so qualified investors must manage their own risks by ensuring they conduct thorough due diligence. As an investor, do you fully understand data centers as a new asset class for private placements?

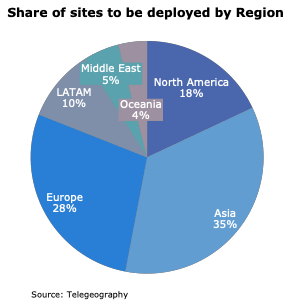

In recent years, AI training models have significantly increased the demand for data centers, leading to the development of mega campuses that require over 1 GW of power. More than 50 commercial data centers now control over 1 million square feet of operational capacity, with at least 20 of these growing at a compound annual growth rate (CAGR) of 10% or more[1]. Currently, around 350 data centers are in various stages of planning and construction worldwide, with the fastest-growing region being Asia.

These data centers are getting larger and cost billions of dollars to build. For example, Google invested about $2.5 billion into its 1.4 million-square-foot facility in Council Bluffs by 2019, while Meta invested more than $1 billion into its 1.25 million-square-foot Prineville facility[2].

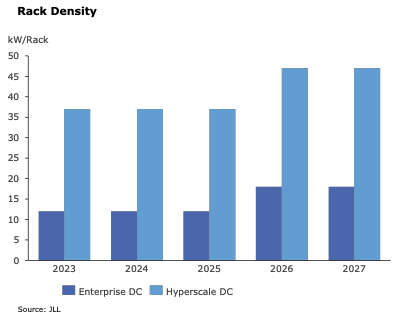

Data centers are also becoming denser, with higher power requirements per rack. Hyperscale facilities are expected to use over 40 kW per rack, with demand continuing to grow[3].

Power and cooling are the biggest factors in bringing data centers online. According to Goldman Sachs, the U.S. will require an additional 47 GW of power generation capacity by 2030, which will involve an estimated $50 billion in cumulative capital investments through 2030.

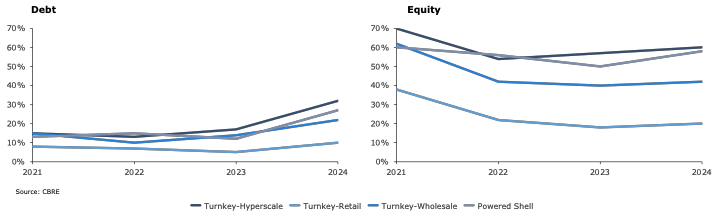

Investors need to raise more funds to finance these facilities. Investor interest in debt financing, particularly for turnkey hyperscale data centers, has risen to 32%[4], as these hyperscalers typically have strong credit ratings.

When these high rated hyperscalers buy wholesale, they are low-risk, dependable customers, often locking in leases for 10 to 15 years. This allows banks to pool these assets into high-grade investments in the asset-backed securities (ABS) market.

| Hyperscaler | Rating[5] |

| Microsoft | AAA/Aaa |

| AA+/Aa2 | |

| Amazon | AA/A1/AA- |

| Meta | AA-/A1 |

| Oracle | BBB/Baa2/BBB |

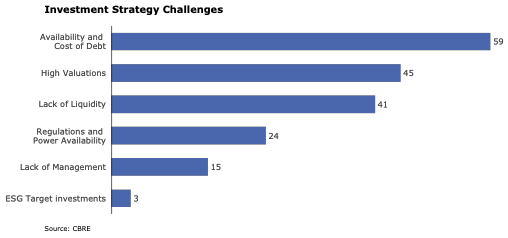

The primary concern for investors is the cost and availability of debt to finance and refinance these facilities[6]. The sheer volume of investment required has also opened opportunities for private placements.

Private placements can be ideal for data center investments, especially due to their faster turnaround times and the ability to keep information private compared to an initial public offering (IPO). This gives data centers a competitive edge in a highly competitive market. However, it requires highly skilled and educated investors, as private placements are minimally regulated under “Reg-D” by the Securities and Exchange Commission (SEC) and thorough due diligence is required.

Doing your due diligence matters?

For now, there is no demand problem, as highlighted above. The biggest challenges will be on the supply side, particularly with power and cooling. Investors need to understand the technical aspects of power and cooling, as the demand is shifting toward alternative cooling methods, such as liquid cooling, for denser facilities. Some facilities may even operate with a hybrid setup, using both air and liquid cooling, as the industry shifts from CPU to GPU processing. This shift is also causing supply chain constraints, particularly with GPUs, which are in limited supply. Potential delays in new GPUs, like the NVIDIA Blackwell[7], are another challenge. These new GPUs not only require different cooling methods but also demand more power.

Power is likely the single biggest issue on the supply side due to several factors:

- In high-demand data center locations, such as Northern Virginia, there is a lack of transmission capacity to deliver power.

- The switch to more sustainable power sources is not happening quickly enough. Solar and wind are helping, but the deployment of small modular reactors (SMRs) would significantly improve the efficiency of energy generation.

- A supply-side crunch exists for equipment used in both data centers and other industries, such as electric vehicle (EV) charging infrastructure, which requires similar components.

Another risk identified during due diligence is access to talent. Although data centers are becoming more automated, there will still be a high demand for skilled workers, especially electricians and plumbers who are critical for managing power and cooling systems.

These factors all contribute to construction delays, particularly for smaller data centers, which struggle to manage their supply chains. Lead times for power and switching equipment can be as long as 52 weeks.

It is in the best interest of both data center operators and investors to conduct thorough commercial and technical due diligence to link market opportunities with business models and ensure they are technically feasible.

Data centers seeking to raise funds should consider conducting vendor or sell-side due diligence to educate potential investors on their offerings. This should be done with the help of a neutral, independent advisor who can provide an outside perspective and challenge the data center’s assumptions, ensuring the investment is attractive to investors while highlighting potential risks and mitigations.

Investors bear the greatest responsibility. Conducting buy-side due diligence is essential to ensure they fulfill their obligations to their investment committees, especially for private placements. An independent advisor with relevant experience can ask the right questions, challenge assumptions, and connect the technical capabilities of the business with commercial viability, thereby mitigating potential investment risks.

[1] Telegeogrpahy – Data Center Dynamics

[2] Data centers: expensive to build, but worth every penny (jll.com)

[3] Data Centers 2024 Global Outlook | JLL Research

[4] 2024 Global Data Center Investor Intentions Survey | CBRE

[5] S&P/Moody’s/Fitch

[6] 2024 Global Data Center Investor Intentions Survey | CBRE

Leave a comment